SPOILER ALERT!

Browsing Personal Insurance: Essential Elements To Assess For Optimum Coverage

Web Content Produce By-Svendsen Nedergaard

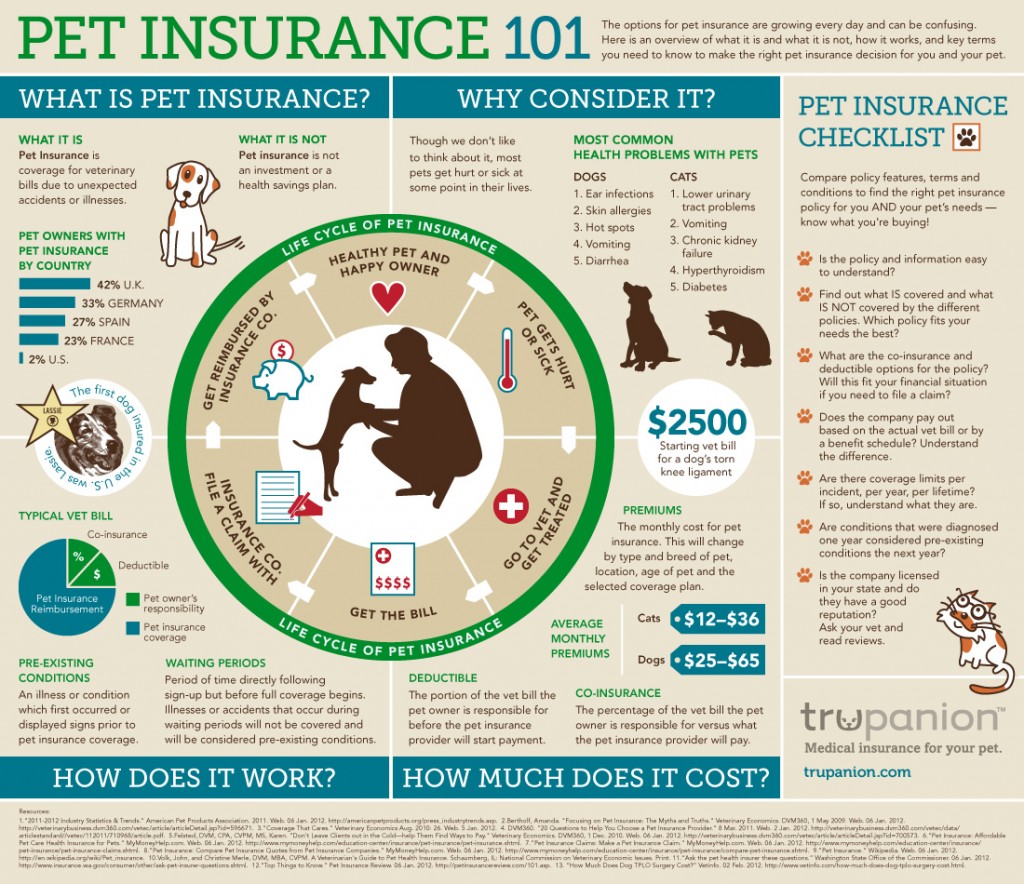

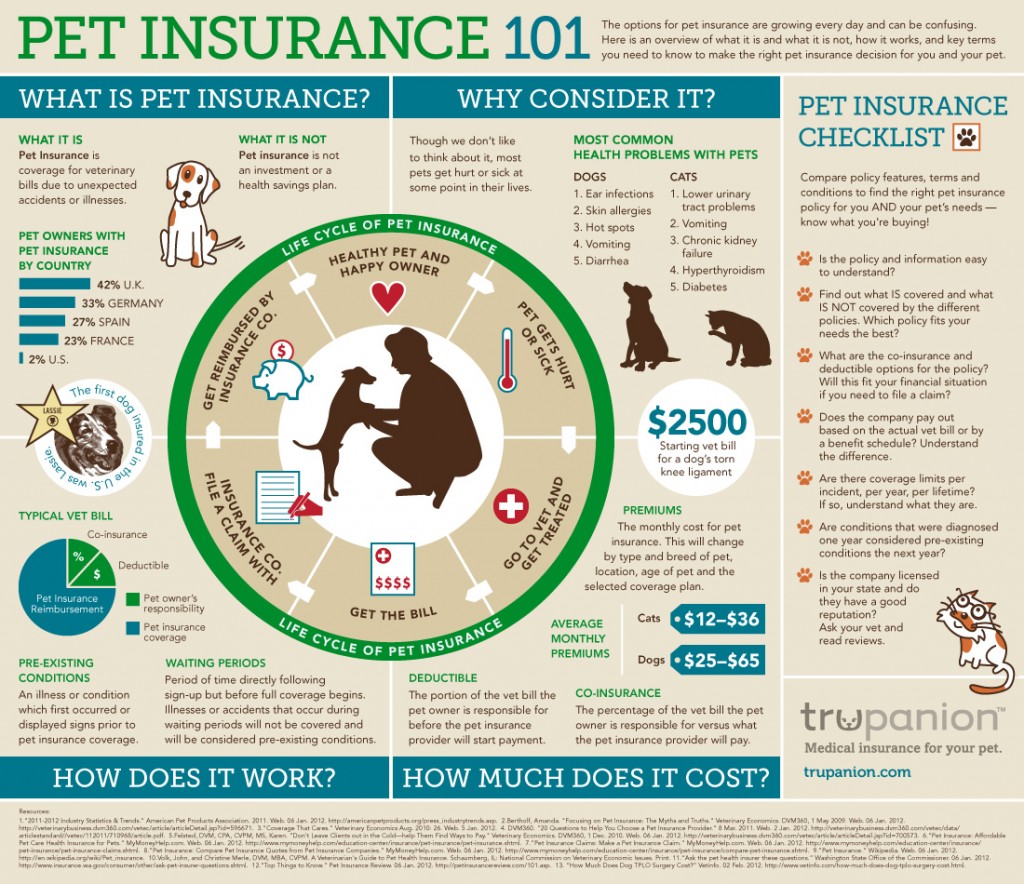

When it concerns personal insurance, browsing the options can feel overwhelming. You need to evaluate your monetary circumstance, understand the sorts of protection available, and consider your future demands. see post 's a cautious balancing act that needs continuous focus to guarantee you're adequately safeguarded. As https://maps.google.com/maps?cid=6940182445390805011 shift, your insurance coverage strategy ought to progress too. So, what aspects should you concentrate on to accomplish ideal security?

Exactly how well do you truly understand your economic landscape? Taking a close look at your existing monetary situation is important for efficient insurance coverage planning.

Beginning by tracking your income, expenses, and savings. You need to recognize where your money goes every month.

Next, assess your debts-- bank card, car loans, and home mortgages can weigh heavily on your monetary health and wellness. Compute your total assets by deducting liabilities from possessions; this provides you a clearer photo of your financial standing.

Do not neglect to factor in your emergency fund, which can offer a safety net during unexpected events.

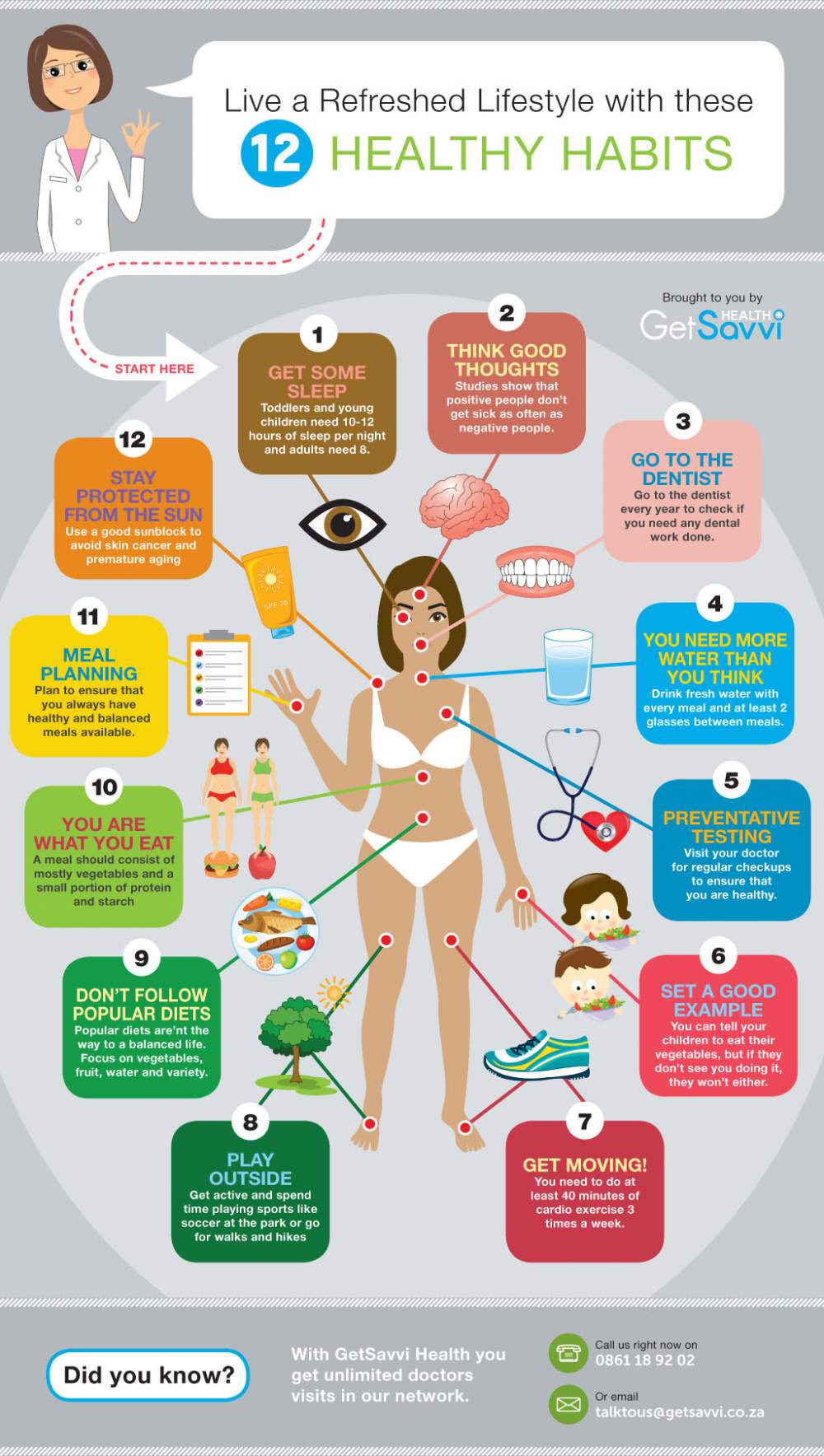

With a clear understanding of your monetary circumstance, you can currently check out the various kinds of individual insurance coverage available to protect your assets and well-being.

Begin with medical insurance, which covers clinical costs and ensures you get necessary treatment.

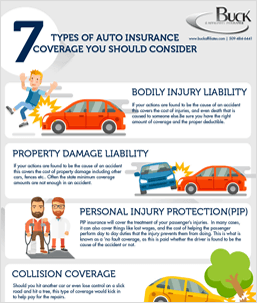

Next off, consider vehicle insurance, required in many areas, shielding you versus obligations from vehicle-related events.

Property owners or renters insurance policy is essential for safeguarding your home and possessions from burglary or damages.

Do not overlook life insurance, which supplies financial backing to your beneficiaries in case of your untimely death.

Lastly, think of disability insurance, using revenue replacement if you can not function due to disease or injury.

Each kind offers an unique objective, assisting you achieve comfort and protection.

What do you envision for your future? As you think about your individual and monetary goals, take into consideration how they'll affect your insurance policy needs.

Are you preparing to purchase a home, start a family, or pursue a brand-new career? Each of these milestones can transform your insurance policy needs.

Assess your existing plans and establish if they line up with your goals. As an example, if you're broadening your household, you could require more life insurance policy to secure their future.

Additionally, consider prospective threats-- will your way of life adjustments result in increased responsibilities?

On a regular basis reviewing your goals ensures your protection develops with you. By evaluating your future requirements, you're not simply shielding on your own today; you're likewise preparing for a protected tomorrow.

Finally, browsing individual insurance coverage is vital for safeguarding your financial future. By frequently analyzing your financial scenario, recognizing the numerous types of protection offered, and assessing your evolving needs and goals, you can guarantee that your insurance policy aligns with your life's ambitions. Do not wait for unanticipated events to catch you off-guard; take positive steps now to accomplish comprehensive defense and appreciate the assurance that features it.

When it concerns personal insurance, browsing the options can feel overwhelming. You need to evaluate your monetary circumstance, understand the sorts of protection available, and consider your future demands. see post 's a cautious balancing act that needs continuous focus to guarantee you're adequately safeguarded. As https://maps.google.com/maps?cid=6940182445390805011 shift, your insurance coverage strategy ought to progress too. So, what aspects should you concentrate on to accomplish ideal security?

Assessing Your Current Financial Scenario

Exactly how well do you truly understand your economic landscape? Taking a close look at your existing monetary situation is important for efficient insurance coverage planning.

Beginning by tracking your income, expenses, and savings. You need to recognize where your money goes every month.

Next, assess your debts-- bank card, car loans, and home mortgages can weigh heavily on your monetary health and wellness. Compute your total assets by deducting liabilities from possessions; this provides you a clearer photo of your financial standing.

Do not neglect to factor in your emergency fund, which can offer a safety net during unexpected events.

Recognizing Various Kinds Of Personal Insurance

With a clear understanding of your monetary circumstance, you can currently check out the various kinds of individual insurance coverage available to protect your assets and well-being.

Begin with medical insurance, which covers clinical costs and ensures you get necessary treatment.

Next off, consider vehicle insurance, required in many areas, shielding you versus obligations from vehicle-related events.

Property owners or renters insurance policy is essential for safeguarding your home and possessions from burglary or damages.

Do not overlook life insurance, which supplies financial backing to your beneficiaries in case of your untimely death.

Lastly, think of disability insurance, using revenue replacement if you can not function due to disease or injury.

Each kind offers an unique objective, assisting you achieve comfort and protection.

Examining Your Future Needs and Objectives

What do you envision for your future? As you think about your individual and monetary goals, take into consideration how they'll affect your insurance policy needs.

Are you preparing to purchase a home, start a family, or pursue a brand-new career? Each of these milestones can transform your insurance policy needs.

Assess your existing plans and establish if they line up with your goals. As an example, if you're broadening your household, you could require more life insurance policy to secure their future.

Additionally, consider prospective threats-- will your way of life adjustments result in increased responsibilities?

On a regular basis reviewing your goals ensures your protection develops with you. By evaluating your future requirements, you're not simply shielding on your own today; you're likewise preparing for a protected tomorrow.

Final thought

Finally, browsing individual insurance coverage is vital for safeguarding your financial future. By frequently analyzing your financial scenario, recognizing the numerous types of protection offered, and assessing your evolving needs and goals, you can guarantee that your insurance policy aligns with your life's ambitions. Do not wait for unanticipated events to catch you off-guard; take positive steps now to accomplish comprehensive defense and appreciate the assurance that features it.

SPOILER ALERT!

Insurance Brokers Clarified: What You Required To Know Prior To Making A Decision

Content Written By-Levine Sehested

When you're navigating the intricate world of insurance policy, understanding exactly how brokers suit the formula can make a large difference. These specialists not only simplify your search for insurance coverage however additionally supply unbiased support customized to your demands. Nevertheless, not all brokers are produced equal. Knowing what to try to find in a broker can dramatically affect your insurance policy experience. So, what should you take into consideration prior to making your option? Let's check out.

When you require insurance, understanding the role of insurance policy brokers can make a significant distinction in your decision-making process.

Insurance coverage brokers function as middlemans between you and insurance provider, helping you browse numerous plans and options available on the market. They assess your distinct needs, allowing them to recommend appropriate protection tailored to your situation.

Unlike representatives that stand for details business, brokers function independently, giving them the adaptability to contrast various companies. This independence allows you to get unbiased recommendations to aid you discover the very best value for your cash.

Furthermore, https://www.topratedlocal.com/v3.0/yext/publisher/profile/1005819543 assist with claims and plan administration, ensuring you comprehend the terms and conditions of your insurance coverage throughout the whole process. Read the Full Article -how can simplify your insurance policy experience dramatically.

Choosing to deal with an insurance broker can enhance your insurance policy experience and save you money and time.

Brokers have accessibility to a large range of insurance items, permitting them to locate the best insurance coverage customized to your certain demands. They'll do the research for you, contrasting plans and prices from numerous insurance providers, guaranteeing you get one of the most competitive prices.

In addition, brokers offer professional guidance, helping you browse the complexities of insurance policy terms and conditions. If you ever need to sue, they'll supply beneficial assistance and assistance, making the process smoother.

Choosing the ideal insurance policy broker can dramatically impact your insurance coverage experience.

First, consider their competence in your certain needs, whether it's auto, home, or organization insurance policy. Search for brokers with a strong online reputation and favorable reviews from clients.

It's also essential to analyze their communication style; you want someone that discusses choices clearly and listens to your worries. Verify their licensing and credentials to ensure they're certified.

In addition, compare fees and commissions, as these can differ widely.

Last but not least, examine their access to multiple insurance coverage suppliers, which can give you better coverage alternatives and pricing.

Taking these factors into account will certainly assist you select a broker who's a great suitable for your needs.

In conclusion, picking the best insurance coverage broker can make a substantial distinction in your coverage experience. By comprehending their function and the benefits they supply, you can discover a broker who fulfills your particular needs. Remember to consider their expertise, reputation, and communication style when making your choice. With the appropriate broker on your side, you'll browse the insurance landscape extra conveniently and secure the best policies tailored just for you.

When you're navigating the intricate world of insurance policy, understanding exactly how brokers suit the formula can make a large difference. These specialists not only simplify your search for insurance coverage however additionally supply unbiased support customized to your demands. Nevertheless, not all brokers are produced equal. Knowing what to try to find in a broker can dramatically affect your insurance policy experience. So, what should you take into consideration prior to making your option? Let's check out.

Comprehending the Role of Insurance Coverage Brokers

When you require insurance, understanding the role of insurance policy brokers can make a significant distinction in your decision-making process.

Insurance coverage brokers function as middlemans between you and insurance provider, helping you browse numerous plans and options available on the market. They assess your distinct needs, allowing them to recommend appropriate protection tailored to your situation.

Unlike representatives that stand for details business, brokers function independently, giving them the adaptability to contrast various companies. This independence allows you to get unbiased recommendations to aid you discover the very best value for your cash.

Furthermore, https://www.topratedlocal.com/v3.0/yext/publisher/profile/1005819543 assist with claims and plan administration, ensuring you comprehend the terms and conditions of your insurance coverage throughout the whole process. Read the Full Article -how can simplify your insurance policy experience dramatically.

Benefits of Dealing With an Insurance Coverage Broker

Choosing to deal with an insurance broker can enhance your insurance policy experience and save you money and time.

Brokers have accessibility to a large range of insurance items, permitting them to locate the best insurance coverage customized to your certain demands. They'll do the research for you, contrasting plans and prices from numerous insurance providers, guaranteeing you get one of the most competitive prices.

In addition, brokers offer professional guidance, helping you browse the complexities of insurance policy terms and conditions. If you ever need to sue, they'll supply beneficial assistance and assistance, making the process smoother.

Variables to Think About When Selecting an Insurance Policy Broker

Choosing the ideal insurance policy broker can dramatically impact your insurance coverage experience.

First, consider their competence in your certain needs, whether it's auto, home, or organization insurance policy. Search for brokers with a strong online reputation and favorable reviews from clients.

It's also essential to analyze their communication style; you want someone that discusses choices clearly and listens to your worries. Verify their licensing and credentials to ensure they're certified.

In addition, compare fees and commissions, as these can differ widely.

Last but not least, examine their access to multiple insurance coverage suppliers, which can give you better coverage alternatives and pricing.

Taking these factors into account will certainly assist you select a broker who's a great suitable for your needs.

Final thought

In conclusion, picking the best insurance coverage broker can make a substantial distinction in your coverage experience. By comprehending their function and the benefits they supply, you can discover a broker who fulfills your particular needs. Remember to consider their expertise, reputation, and communication style when making your choice. With the appropriate broker on your side, you'll browse the insurance landscape extra conveniently and secure the best policies tailored just for you.

SPOILER ALERT!

Understand Exactly How Insurance Coverage Brokers Can Facilitate Your Protection Selections And Illuminate The Benefits They Offer, Causing You To Assess Just How Much You Can Potentially Conserve

Authored By-Klint Warming

When it involves insurance, browsing your options can really feel frustrating. That's where insurance policy brokers been available in. They function as middlemans, assisting you assess your one-of-a-kind coverage demands and find the best policies. But exactly how precisely do they work, and what benefits can you anticipate from partnering with one? Recognizing these aspects can make a substantial difference in your insurance coverage experience. Allow's discover what you need to recognize.

When you need insurance policy, comprehending what an insurance policy broker does can make your search less complicated.

An insurance broker acts as an intermediary in between you and insurance companies. http://www.yext.com/partnerpages/aroundme/luxe-insurance-brokers-scottsdale-arizona-us-052da0 do not stand for any kind of single insurance company, which implies they can offer you a range of options customized to your needs.

Brokers help you evaluate your coverage demands and compare different plans. They'll collect quotes, clarify terms, and guide you with the intricacies of insurance coverage lingo.

Once you pick a plan, they help with the application procedure and ensure you comprehend what you're signing.

Throughout your insurance journey, brokers give valuable support, responding to questions and resolving problems, making navigating the insurance policy landscape extra convenient for you.

Selecting to collaborate with an insurance policy broker provides numerous benefits that can simplify your insurance policy experience.

First, brokers have extensive expertise of the insurance market, helping you browse various coverage alternatives customized to your needs. They save you time by contrasting quotes from several insurance providers, guaranteeing you get the very best deal feasible.

Additionally, brokers advocate for you throughout the claims process, making it less complicated to resolve problems quickly. They additionally remain updated on industry adjustments, so you can feel great that you're obtaining exact recommendations.

In addition, using a broker usually implies you have accessibility to exclusive plans and discount rates that you mightn't discover by yourself.

To get the most out of your experience with an insurance broker, it's essential to communicate freely concerning your requirements and problems. Be clear concerning your budget, coverage choices, and any kind of certain risks you face. This openness helps your broker dressmaker alternatives that fit you ideal.

Do not wait to ask inquiries; an excellent broker will value your inquisitiveness. Remember during your discussions to keep track of crucial details.

Likewise, examine your insurance coverage on a regular basis with your broker to guarantee it still fulfills your needs.

Finally, develop a relationship based upon depend on. If you feel comfy, share individual insights that could affect your coverage. The more your broker recognizes, the better they can offer you.

In summary, working with an insurance broker can streamline your protection journey and guarantee you locate the very best alternatives for your needs. They're your supporters in the complicated insurance policy landscape, offering insights and assistance as your conditions change. By complying with the tips to maximize your experience, you'll be fully equipped to make informed decisions. High Net Worth Insurance be reluctant to lean on their competence-- it's a smart action toward safeguarding the right protection for you and your assets.

When it involves insurance, browsing your options can really feel frustrating. That's where insurance policy brokers been available in. They function as middlemans, assisting you assess your one-of-a-kind coverage demands and find the best policies. But exactly how precisely do they work, and what benefits can you anticipate from partnering with one? Recognizing these aspects can make a substantial difference in your insurance coverage experience. Allow's discover what you need to recognize.

What Is an Insurance policy Broker and Just How Do They Function?

When you need insurance policy, comprehending what an insurance policy broker does can make your search less complicated.

An insurance broker acts as an intermediary in between you and insurance companies. http://www.yext.com/partnerpages/aroundme/luxe-insurance-brokers-scottsdale-arizona-us-052da0 do not stand for any kind of single insurance company, which implies they can offer you a range of options customized to your needs.

Brokers help you evaluate your coverage demands and compare different plans. They'll collect quotes, clarify terms, and guide you with the intricacies of insurance coverage lingo.

Once you pick a plan, they help with the application procedure and ensure you comprehend what you're signing.

Throughout your insurance journey, brokers give valuable support, responding to questions and resolving problems, making navigating the insurance policy landscape extra convenient for you.

The Advantages of Using an Insurance Coverage Broker

Selecting to collaborate with an insurance policy broker provides numerous benefits that can simplify your insurance policy experience.

First, brokers have extensive expertise of the insurance market, helping you browse various coverage alternatives customized to your needs. They save you time by contrasting quotes from several insurance providers, guaranteeing you get the very best deal feasible.

Additionally, brokers advocate for you throughout the claims process, making it less complicated to resolve problems quickly. They additionally remain updated on industry adjustments, so you can feel great that you're obtaining exact recommendations.

In addition, using a broker usually implies you have accessibility to exclusive plans and discount rates that you mightn't discover by yourself.

Tips for Optimizing Your Experience With Insurance Brokers

To get the most out of your experience with an insurance broker, it's essential to communicate freely concerning your requirements and problems. Be clear concerning your budget, coverage choices, and any kind of certain risks you face. This openness helps your broker dressmaker alternatives that fit you ideal.

Do not wait to ask inquiries; an excellent broker will value your inquisitiveness. Remember during your discussions to keep track of crucial details.

Likewise, examine your insurance coverage on a regular basis with your broker to guarantee it still fulfills your needs.

Finally, develop a relationship based upon depend on. If you feel comfy, share individual insights that could affect your coverage. The more your broker recognizes, the better they can offer you.

Final thought

In summary, working with an insurance broker can streamline your protection journey and guarantee you locate the very best alternatives for your needs. They're your supporters in the complicated insurance policy landscape, offering insights and assistance as your conditions change. By complying with the tips to maximize your experience, you'll be fully equipped to make informed decisions. High Net Worth Insurance be reluctant to lean on their competence-- it's a smart action toward safeguarding the right protection for you and your assets.

SPOILER ALERT!

What Methods Can Insurance Policy Representatives Use In Communication To Cultivate Lasting Relationships With Their Customers?

Short Article Author-Gravesen Morton

As an insurance representative, you recognize that constructing strong client relationships is vital for success. It starts with understanding your customers' distinct requirements and choices. By promoting open interaction, you can develop an atmosphere where clients feel valued and recognized. But how do you guarantee your solution not just fulfills their assumptions but also adjusts to their advancing demands? Allow's explore some reliable techniques that can strengthen those vital connections.

To construct a solid customer partnership, you require to recognize their distinct needs and choices. Start by asking flexible inquiries throughout your initial meetings. This approach aids reveal what matters most to them-- be it spending plan constraints, details protection types, or lasting objectives.

Pay very close attention to their reactions; it's important to pay attention proactively. Make note to bear in mind vital details that might influence your recommendations later on. Don't wait to follow up with making clear questions if you're unclear about something. By showing real interest in their conditions, you'll cultivate trust and connection.

Consistently take another look at these requirements as scenarios change, guaranteeing you adjust your services as necessary. This recurring understanding is important to preserving a solid, long lasting customer connection.

Comprehending your customers' requirements develops the foundation, but efficient communication takes that relationship even more. To get in touch with clients, pay attention actively and reveal genuine rate of interest in their worries.

Usage clear, straightforward language; stay clear of jargon that could puzzle them. On https://www.businesswire.com/news/home/20240905793735/en/Miami-Dolphins-Select-EPIC-Insurance-Brokers-Consultants-as-an-Official-Insurance-Partner in with calls or e-mails, ensuring they feel valued and notified. Dressmaker your communication style to match their preferences-- some may choose comprehensive explanations, while others appreciate brevity.

Do not undervalue the power of non-verbal signs; maintain eye contact and utilize open body movement during in person conferences. Last but not least, be transparent concerning policies and procedures.

While providing remarkable solution might look like a fundamental expectation, it's the essential to building count on with your customers. When you go above and beyond, you reveal that you genuinely respect their needs. Reacting promptly to questions and giving clear, accurate info aids clients really feel valued and comprehended.

Furthermore, customize your service by remembering important information regarding their lives and choices. This shows that you see them as more than just a policyholder.

Constantly follow up after a claim or an assessment to guarantee their fulfillment. This positive strategy not just enhances trust fund yet also maintains the lines of interaction open.

To conclude, constructing strong client partnerships as an insurance policy representative hinges on comprehending their requirements and choices. By interacting properly and offering remarkable service, you cultivate trust and loyalty. Keep in mind to keep your language clear and prevent lingo to make sure customers really feel educated and valued. Routine check-ins and customized communications show that you truly appreciate their objectives. By adapting your solutions and motivating feedback, you'll produce long-term connections that profit both you and your clients.

As an insurance representative, you recognize that constructing strong client relationships is vital for success. It starts with understanding your customers' distinct requirements and choices. By promoting open interaction, you can develop an atmosphere where clients feel valued and recognized. But how do you guarantee your solution not just fulfills their assumptions but also adjusts to their advancing demands? Allow's explore some reliable techniques that can strengthen those vital connections.

Comprehending Client Demands and Preferences

To construct a solid customer partnership, you require to recognize their distinct needs and choices. Start by asking flexible inquiries throughout your initial meetings. This approach aids reveal what matters most to them-- be it spending plan constraints, details protection types, or lasting objectives.

Pay very close attention to their reactions; it's important to pay attention proactively. Make note to bear in mind vital details that might influence your recommendations later on. Don't wait to follow up with making clear questions if you're unclear about something. By showing real interest in their conditions, you'll cultivate trust and connection.

Consistently take another look at these requirements as scenarios change, guaranteeing you adjust your services as necessary. This recurring understanding is important to preserving a solid, long lasting customer connection.

Effective Communication Methods

Comprehending your customers' requirements develops the foundation, but efficient communication takes that relationship even more. To get in touch with clients, pay attention actively and reveal genuine rate of interest in their worries.

Usage clear, straightforward language; stay clear of jargon that could puzzle them. On https://www.businesswire.com/news/home/20240905793735/en/Miami-Dolphins-Select-EPIC-Insurance-Brokers-Consultants-as-an-Official-Insurance-Partner in with calls or e-mails, ensuring they feel valued and notified. Dressmaker your communication style to match their preferences-- some may choose comprehensive explanations, while others appreciate brevity.

Do not undervalue the power of non-verbal signs; maintain eye contact and utilize open body movement during in person conferences. Last but not least, be transparent concerning policies and procedures.

Structure Trust Fund Through Exceptional Service

While providing remarkable solution might look like a fundamental expectation, it's the essential to building count on with your customers. When you go above and beyond, you reveal that you genuinely respect their needs. Reacting promptly to questions and giving clear, accurate info aids clients really feel valued and comprehended.

Furthermore, customize your service by remembering important information regarding their lives and choices. This shows that you see them as more than just a policyholder.

Constantly follow up after a claim or an assessment to guarantee their fulfillment. This positive strategy not just enhances trust fund yet also maintains the lines of interaction open.

Verdict

To conclude, constructing strong client partnerships as an insurance policy representative hinges on comprehending their requirements and choices. By interacting properly and offering remarkable service, you cultivate trust and loyalty. Keep in mind to keep your language clear and prevent lingo to make sure customers really feel educated and valued. Routine check-ins and customized communications show that you truly appreciate their objectives. By adapting your solutions and motivating feedback, you'll produce long-term connections that profit both you and your clients.

SPOILER ALERT!

Just How Can Insurance Policy Representatives Effectively Use Interaction To Strengthen And Keep Long-Term Connections With Their Clients?

Short Article Author-Gravesen Morton

As an insurance representative, you recognize that constructing strong client relationships is vital for success. It starts with understanding your customers' distinct requirements and choices. By promoting open interaction, you can develop an atmosphere where clients feel valued and recognized. But how do you guarantee your solution not just fulfills their assumptions but also adjusts to their advancing demands? Allow's explore some reliable techniques that can strengthen those vital connections.

To construct a solid customer partnership, you require to recognize their distinct needs and choices. Start by asking flexible inquiries throughout your initial meetings. This approach aids reveal what matters most to them-- be it spending plan constraints, details protection types, or lasting objectives.

Pay very close attention to their reactions; it's important to pay attention proactively. Make note to bear in mind vital details that might influence your recommendations later on. Don't wait to follow up with making clear questions if you're unclear about something. By showing real interest in their conditions, you'll cultivate trust and connection.

Consistently take another look at these requirements as scenarios change, guaranteeing you adjust your services as necessary. This recurring understanding is important to preserving a solid, long lasting customer connection.

Comprehending your customers' requirements develops the foundation, but efficient communication takes that relationship even more. To get in touch with clients, pay attention actively and reveal genuine rate of interest in their worries.

Usage clear, straightforward language; stay clear of jargon that could puzzle them. On https://www.businesswire.com/news/home/20240905793735/en/Miami-Dolphins-Select-EPIC-Insurance-Brokers-Consultants-as-an-Official-Insurance-Partner in with calls or e-mails, ensuring they feel valued and notified. Dressmaker your communication style to match their preferences-- some may choose comprehensive explanations, while others appreciate brevity.

Do not undervalue the power of non-verbal signs; maintain eye contact and utilize open body movement during in person conferences. Last but not least, be transparent concerning policies and procedures.

While providing remarkable solution might look like a fundamental expectation, it's the essential to building count on with your customers. When you go above and beyond, you reveal that you genuinely respect their needs. Reacting promptly to questions and giving clear, accurate info aids clients really feel valued and comprehended.

Furthermore, customize your service by remembering important information regarding their lives and choices. This shows that you see them as more than just a policyholder.

Constantly follow up after a claim or an assessment to guarantee their fulfillment. This positive strategy not just enhances trust fund yet also maintains the lines of interaction open.

To conclude, constructing strong client partnerships as an insurance policy representative hinges on comprehending their requirements and choices. By interacting properly and offering remarkable service, you cultivate trust and loyalty. Keep in mind to keep your language clear and prevent lingo to make sure customers really feel educated and valued. Routine check-ins and customized communications show that you truly appreciate their objectives. By adapting your solutions and motivating feedback, you'll produce long-term connections that profit both you and your clients.

As an insurance representative, you recognize that constructing strong client relationships is vital for success. It starts with understanding your customers' distinct requirements and choices. By promoting open interaction, you can develop an atmosphere where clients feel valued and recognized. But how do you guarantee your solution not just fulfills their assumptions but also adjusts to their advancing demands? Allow's explore some reliable techniques that can strengthen those vital connections.

Comprehending Client Demands and Preferences

To construct a solid customer partnership, you require to recognize their distinct needs and choices. Start by asking flexible inquiries throughout your initial meetings. This approach aids reveal what matters most to them-- be it spending plan constraints, details protection types, or lasting objectives.

Pay very close attention to their reactions; it's important to pay attention proactively. Make note to bear in mind vital details that might influence your recommendations later on. Don't wait to follow up with making clear questions if you're unclear about something. By showing real interest in their conditions, you'll cultivate trust and connection.

Consistently take another look at these requirements as scenarios change, guaranteeing you adjust your services as necessary. This recurring understanding is important to preserving a solid, long lasting customer connection.

Effective Communication Methods

Comprehending your customers' requirements develops the foundation, but efficient communication takes that relationship even more. To get in touch with clients, pay attention actively and reveal genuine rate of interest in their worries.

Usage clear, straightforward language; stay clear of jargon that could puzzle them. On https://www.businesswire.com/news/home/20240905793735/en/Miami-Dolphins-Select-EPIC-Insurance-Brokers-Consultants-as-an-Official-Insurance-Partner in with calls or e-mails, ensuring they feel valued and notified. Dressmaker your communication style to match their preferences-- some may choose comprehensive explanations, while others appreciate brevity.

Do not undervalue the power of non-verbal signs; maintain eye contact and utilize open body movement during in person conferences. Last but not least, be transparent concerning policies and procedures.

Structure Trust Fund Through Exceptional Service

While providing remarkable solution might look like a fundamental expectation, it's the essential to building count on with your customers. When you go above and beyond, you reveal that you genuinely respect their needs. Reacting promptly to questions and giving clear, accurate info aids clients really feel valued and comprehended.

Furthermore, customize your service by remembering important information regarding their lives and choices. This shows that you see them as more than just a policyholder.

Constantly follow up after a claim or an assessment to guarantee their fulfillment. This positive strategy not just enhances trust fund yet also maintains the lines of interaction open.

Verdict

To conclude, constructing strong client partnerships as an insurance policy representative hinges on comprehending their requirements and choices. By interacting properly and offering remarkable service, you cultivate trust and loyalty. Keep in mind to keep your language clear and prevent lingo to make sure customers really feel educated and valued. Routine check-ins and customized communications show that you truly appreciate their objectives. By adapting your solutions and motivating feedback, you'll produce long-term connections that profit both you and your clients.

SPOILER ALERT!

Top 5 Reasons To Companion With A Regional Insurance Company

Material Composed By-Wentworth Lauridsen

When it pertains to picking an insurance agency, working with a local one can provide distinct benefits. You'll locate tailored solution that's customized to your specific demands, together with representatives who genuinely understand the distinct threats in your neighborhood. This degree of experience can make a real difference in your protection options. Yet that's simply the start. Allow's explore what else a local company can provide for you.

When you pick to deal with a regional insurance coverage agency, you gain access to customized service that's customized specifically to your demands. You're not just one more plan number; your agent takes the time to understand your special circumstance and choices.

https://pierre-michael.federatedjournals.com/keep-reading-to-uncover-exactly-how-insurance-brokers-simplify-your-policy-administration-conserving-you-valuable-time-and-money-while-optimizing-your-protection-options allows them to advise insurance coverage alternatives that fit your lifestyle and financial goals. With regional representatives, you can expect quick reactions and direct interaction, which indicates you will not lose time waiting for answers.

They're bought your neighborhood, so they can give insights that resonate with your environment. By functioning closely with each other, you'll feel a lot more positive in your insurance selections, knowing you have someone who genuinely respects shielding what matters most to you.

Since regional insurance coverage agents are deeply rooted in your community, they have an in-depth knowledge of the specific threats you encounter. They comprehend the one-of-a-kind challenges your location offers, whether it's all-natural disasters, criminal activity rates, or local economic changes.

This knowledge allows them to evaluate your situation properly and recommend coverage that genuinely meets your requirements. Unlike larger, nationwide companies, local representatives can give insights into fads and occasions that may affect your insurance coverage needs.

They understand which plans offer the most effective security against neighborhood dangers, guaranteeing you're not over- or under-insured. With their know-how, you can navigate your insurance coverage options with confidence, knowing you're completely covered for the risks certain to your area.

Regional insurance companies prosper on solid area relationships, which substantially enhances their ability to serve your needs.

When you deal with a neighborhood firm, you're partnering with people that recognize the special difficulties and possibilities your community faces. They're not simply marketing plans; they're constructing connections with local businesses and families. This experience enables them to customize insurance services that fit your specific circumstance.

In addition, regional representatives frequently support area occasions and initiatives, enhancing their dedication to the area. This involvement indicates they're a lot more bought your health.

You can trust that your local agency will certainly promote for you, ensuring you obtain customized service and support. Basically, strong area ties enable them to be much more responsive and efficient in addressing your insurance coverage requires.

One significant benefit of dealing with a regional insurance coverage agency is the availability and benefit they offer. You can conveniently see their office whenever you need support or have inquiries, without the problem of long-distance travel.

Neighborhood agencies typically have adaptable hours, making it less complicated to discover a time that fits your schedule. Plus, you're likely to communicate with acquainted faces who recognize your unique needs and local context.

Interaction is much more simple given that you can call or stop by for instant support. In a globe where online solutions are prevalent, having a regional firm means you can still take pleasure in a personal touch while accessing essential insurance coverage services swiftly and successfully.

It's all about making your life much easier.

When you're navigating the cases process, having a neighborhood insurance policy firm on your side can make all the distinction.

You'll benefit from tailored help customized to your special circumstance. Your regional representative understands the ins and outs of your plan and can lead you through every action, guaranteeing you do not miss out on any type of crucial information.

They'll aid you gather necessary paperwork, send insurance claims effectively, and interact with insurance adjusters in your place. This support minimizes your anxiety and speeds up the procedure, so you can focus on recouping from your loss.

And also, if concerns arise, your regional agent is just a phone call away, all set to advocate for you and ensure you obtain the most effective feasible outcome.

Collaborating with a regional insurance coverage agency genuinely makes a difference. You'll appreciate the individualized service that accommodates your special needs and the representatives' deep understanding of local risks. Their solid connections to the area guarantee you're well-represented, and their access means you can obtain aid whenever you require it. Plus, when it involves cases, you'll have committed support assisting you every action of the means. Picking regional is a smart selection for your insurance needs!

When it pertains to picking an insurance agency, working with a local one can provide distinct benefits. You'll locate tailored solution that's customized to your specific demands, together with representatives who genuinely understand the distinct threats in your neighborhood. This degree of experience can make a real difference in your protection options. Yet that's simply the start. Allow's explore what else a local company can provide for you.

Personalized Solution Tailored to Your Needs

When you pick to deal with a regional insurance coverage agency, you gain access to customized service that's customized specifically to your demands. You're not just one more plan number; your agent takes the time to understand your special circumstance and choices.

https://pierre-michael.federatedjournals.com/keep-reading-to-uncover-exactly-how-insurance-brokers-simplify-your-policy-administration-conserving-you-valuable-time-and-money-while-optimizing-your-protection-options allows them to advise insurance coverage alternatives that fit your lifestyle and financial goals. With regional representatives, you can expect quick reactions and direct interaction, which indicates you will not lose time waiting for answers.

They're bought your neighborhood, so they can give insights that resonate with your environment. By functioning closely with each other, you'll feel a lot more positive in your insurance selections, knowing you have someone who genuinely respects shielding what matters most to you.

Thorough Expertise of Local Risks

Since regional insurance coverage agents are deeply rooted in your community, they have an in-depth knowledge of the specific threats you encounter. They comprehend the one-of-a-kind challenges your location offers, whether it's all-natural disasters, criminal activity rates, or local economic changes.

This knowledge allows them to evaluate your situation properly and recommend coverage that genuinely meets your requirements. Unlike larger, nationwide companies, local representatives can give insights into fads and occasions that may affect your insurance coverage needs.

They understand which plans offer the most effective security against neighborhood dangers, guaranteeing you're not over- or under-insured. With their know-how, you can navigate your insurance coverage options with confidence, knowing you're completely covered for the risks certain to your area.

Solid Area Relationships

Regional insurance companies prosper on solid area relationships, which substantially enhances their ability to serve your needs.

When you deal with a neighborhood firm, you're partnering with people that recognize the special difficulties and possibilities your community faces. They're not simply marketing plans; they're constructing connections with local businesses and families. This experience enables them to customize insurance services that fit your specific circumstance.

In addition, regional representatives frequently support area occasions and initiatives, enhancing their dedication to the area. This involvement indicates they're a lot more bought your health.

You can trust that your local agency will certainly promote for you, ensuring you obtain customized service and support. Basically, strong area ties enable them to be much more responsive and efficient in addressing your insurance coverage requires.

Availability and Convenience

One significant benefit of dealing with a regional insurance coverage agency is the availability and benefit they offer. You can conveniently see their office whenever you need support or have inquiries, without the problem of long-distance travel.

Neighborhood agencies typically have adaptable hours, making it less complicated to discover a time that fits your schedule. Plus, you're likely to communicate with acquainted faces who recognize your unique needs and local context.

Interaction is much more simple given that you can call or stop by for instant support. In a globe where online solutions are prevalent, having a regional firm means you can still take pleasure in a personal touch while accessing essential insurance coverage services swiftly and successfully.

It's all about making your life much easier.

Assistance During Claims Refine

When you're navigating the cases process, having a neighborhood insurance policy firm on your side can make all the distinction.

You'll benefit from tailored help customized to your special circumstance. Your regional representative understands the ins and outs of your plan and can lead you through every action, guaranteeing you do not miss out on any type of crucial information.

They'll aid you gather necessary paperwork, send insurance claims effectively, and interact with insurance adjusters in your place. This support minimizes your anxiety and speeds up the procedure, so you can focus on recouping from your loss.

And also, if concerns arise, your regional agent is just a phone call away, all set to advocate for you and ensure you obtain the most effective feasible outcome.

Verdict

Collaborating with a regional insurance coverage agency genuinely makes a difference. You'll appreciate the individualized service that accommodates your special needs and the representatives' deep understanding of local risks. Their solid connections to the area guarantee you're well-represented, and their access means you can obtain aid whenever you require it. Plus, when it involves cases, you'll have committed support assisting you every action of the means. Picking regional is a smart selection for your insurance needs!

SPOILER ALERT!

With This Step-By-Step Guide, Discover The Vital Actions To Kickstart Your Occupation As An Insurance Representative And Unlock Your Capacity For Success

Writer-Bruus Gormsen

Beginning your career as an insurance policy agent can be a fulfilling trip, but it needs careful planning and implementation. You need to understand the different types of insurance readily available and the particular demands in your state. Once you've got that down, the path to obtaining your permit is the next step. Yet what follows that? Let's check out exactly how to develop your customer base successfully and set yourself up for long-lasting success.

When you begin your profession as an insurance policy agent, it's important to understand the various sorts of insurance readily available.

You'll come across various options, consisting of life, health, automobile, and homeowners insurance policy. Each kind serves an one-of-a-kind objective and fulfills particular needs for customers. Life insurance policy gives economic protection for loved ones, while health insurance covers clinical expenses. Vehicle insurance protects against vehicle-related cases, and property owners insurance safeguards residential property and belongings.

Acquainting on your own with these choices will certainly help you tailor options for your customers. In addition, understanding the nuances of insurance coverage, exclusions, and policy limitations is vital. Personal Watercraft Insurance Coverage develops trust fund however additionally placements you as a dependable resource.

Understanding the various sorts of insurance policy establishes the stage for the next action in your trip: acquiring your insurance policy permit.

To start, inspect your state's demands, as they can differ significantly. Usually, you'll need to finish pre-licensing education and learning, which covers essential subjects like plan kinds and guidelines.

When Learn Alot more Here 've finished your coursework, you'll need to schedule your licensing exam. See to it you research completely, as passing this exam is crucial.

After passing, you can request your certificate with your state's insurance division. Be prepared to give individual info and possibly go through a background check.

Once you get your certificate, you're one step closer to releasing your profession as an insurance coverage representative!

As you start your journey as an insurance coverage representative, structure and expanding your client base is essential for long-lasting success. Begin by leveraging your personal network. Reach out to family members, buddies, and associates, letting them know about your brand-new role.

Participate in neighborhood events and join neighborhood groups to get in touch with possible customers.

Utilize social media sites platforms to showcase your know-how and involve with your audience. Produce important web content that attends to common insurance concerns.

Do not take too lightly the power of references; ask pleased clients for introductions to others.

Keep arranged by monitoring leads and following up continually. Keep in mind, partnerships matter-- focus on providing outstanding solution to cultivate depend on and commitment.

With devotion and initiative, you'll continuously increase your client base.

Beginning your career as an insurance representative can be a rewarding trip. By recognizing https://click4r.com/posts/g/21048393/get-ready-to-explore-the-important-actions-associated-with-ending-up-b of insurance coverage, obtaining your permit, and proactively developing your client base, you established the stage for success. Keep in mind to nurture your connections with customers via exceptional service and consistent follow-ups. With dedication and initiative, you'll not only grow your organization however also make a favorable influence in your customers' lives. Accept the procedure, and see your job thrive!

Beginning your career as an insurance policy agent can be a fulfilling trip, but it needs careful planning and implementation. You need to understand the different types of insurance readily available and the particular demands in your state. Once you've got that down, the path to obtaining your permit is the next step. Yet what follows that? Let's check out exactly how to develop your customer base successfully and set yourself up for long-lasting success.

Understanding the Different Sorts Of Insurance Coverage

When you begin your profession as an insurance policy agent, it's important to understand the various sorts of insurance readily available.

You'll come across various options, consisting of life, health, automobile, and homeowners insurance policy. Each kind serves an one-of-a-kind objective and fulfills particular needs for customers. Life insurance policy gives economic protection for loved ones, while health insurance covers clinical expenses. Vehicle insurance protects against vehicle-related cases, and property owners insurance safeguards residential property and belongings.

Acquainting on your own with these choices will certainly help you tailor options for your customers. In addition, understanding the nuances of insurance coverage, exclusions, and policy limitations is vital. Personal Watercraft Insurance Coverage develops trust fund however additionally placements you as a dependable resource.

Getting Your Insurance Certificate

Understanding the various sorts of insurance policy establishes the stage for the next action in your trip: acquiring your insurance policy permit.

To start, inspect your state's demands, as they can differ significantly. Usually, you'll need to finish pre-licensing education and learning, which covers essential subjects like plan kinds and guidelines.

When Learn Alot more Here 've finished your coursework, you'll need to schedule your licensing exam. See to it you research completely, as passing this exam is crucial.

After passing, you can request your certificate with your state's insurance division. Be prepared to give individual info and possibly go through a background check.

Once you get your certificate, you're one step closer to releasing your profession as an insurance coverage representative!

Building and Growing Your Client Base

As you start your journey as an insurance coverage representative, structure and expanding your client base is essential for long-lasting success. Begin by leveraging your personal network. Reach out to family members, buddies, and associates, letting them know about your brand-new role.

Participate in neighborhood events and join neighborhood groups to get in touch with possible customers.

Utilize social media sites platforms to showcase your know-how and involve with your audience. Produce important web content that attends to common insurance concerns.

Do not take too lightly the power of references; ask pleased clients for introductions to others.

Keep arranged by monitoring leads and following up continually. Keep in mind, partnerships matter-- focus on providing outstanding solution to cultivate depend on and commitment.

With devotion and initiative, you'll continuously increase your client base.

Verdict

Beginning your career as an insurance representative can be a rewarding trip. By recognizing https://click4r.com/posts/g/21048393/get-ready-to-explore-the-important-actions-associated-with-ending-up-b of insurance coverage, obtaining your permit, and proactively developing your client base, you established the stage for success. Keep in mind to nurture your connections with customers via exceptional service and consistent follow-ups. With dedication and initiative, you'll not only grow your organization however also make a favorable influence in your customers' lives. Accept the procedure, and see your job thrive!

SPOILER ALERT!

Personal Insurance Coverage: Vital Suggestions For Educated Selections

Material Author-Vilstrup Steffensen

When it pertains to personal insurance policy, navigating your choices can really feel frustrating. You need to examine your unique requirements and recognize the various sorts of coverage available. From health and automobile to life and house owners, each serves a details objective. Understanding how to prioritize your protection can make a significant difference. However what should you consider when comparing policies? Allow's explore some crucial pointers to aid you make informed decisions.

When it pertains to protecting your economic future, comprehending the different sorts of individual insurance coverage is critical. You'll experience a number of essential options, each serving unique functions.

Medical insurance aids cover medical expenses, ensuring you obtain needed treatment without a heavy financial problem. Life insurance policy gives financial backing for your liked ones in case of your unforeseen death. Vehicle insurance policy protects you against losses related to vehicle mishaps, while house owners or renters insurance policy safeguards your residential or commercial property and possessions.

Additionally, disability insurance uses income replacement if you can not work as a result of injury or health problem. By familiarizing on your own with these choices, you can make educated choices that line up with your needs and goals, ultimately reinforcing your economic security.

Exactly how can you guarantee you have the right coverage for your special scenarios? Start by taking a close check out your way of life, assets, and potential risks.

Take into consideration variables like your age, health and wellness, household situation, and the worth of your belongings. Make a listing of what's most important to secure-- whether it's your home, car, or personal valuables.

Next off, assess any existing insurance coverage you currently have. Are there spaces? Do https://shane41marica.bravejournal.net/check-out-the-8-usual-mistakes-to-stay-away-from-while-working-alongside need essentially coverage in particular areas?

Talk to an insurance coverage professional who can aid identify your requirements based on your situation. Inevitably, recognizing your personal threats and economic obligations will certainly guide you in selecting the ideal insurance plan to provide comfort.

What should you try to find when contrasting insurance plan? Beginning by checking out protection choices. Make sure the plans cover the details threats you're worried regarding.

Next off, examine the premiums-- contrast expenses, but do not make rate your just determining variable. Take a look at deductibles; a lower costs frequently means a greater deductible, which could affect your funds throughout a case.

Analyze the insurance firm's online reputation by checking out evaluations and checking their monetary security. Also, understand the insurance claims procedure-- guarantee it's straightforward and straightforward.

Ultimately, do not fail to remember to ask about price cuts; lots of insurance firms use discounts for packing policies or having a good driving document. Taking https://zenwriting.net/janise5jamison/the-essential-nature-of-personal-insurance-coverage-just-how-to-protect-your helps you make an informed choice that finest matches your demands.

To conclude, navigating personal insurance doesn't have to be overwhelming. By recognizing simply click the next website page of insurance coverage, assessing your one-of-a-kind requirements, and comparing plans, you can make informed decisions that shield your assets and well-being. Do not wait to speak with specialists for customized guidance, and keep in mind to assess your plans on a regular basis. With a positive technique, you can ensure you have the best coverage while optimizing your advantages and decreasing expenses. Remain notified and protected!

When it pertains to personal insurance policy, navigating your choices can really feel frustrating. You need to examine your unique requirements and recognize the various sorts of coverage available. From health and automobile to life and house owners, each serves a details objective. Understanding how to prioritize your protection can make a significant difference. However what should you consider when comparing policies? Allow's explore some crucial pointers to aid you make informed decisions.

Comprehending Various Types of Personal Insurance Policy

When it pertains to protecting your economic future, comprehending the different sorts of individual insurance coverage is critical. You'll experience a number of essential options, each serving unique functions.

Medical insurance aids cover medical expenses, ensuring you obtain needed treatment without a heavy financial problem. Life insurance policy gives financial backing for your liked ones in case of your unforeseen death. Vehicle insurance policy protects you against losses related to vehicle mishaps, while house owners or renters insurance policy safeguards your residential or commercial property and possessions.

Additionally, disability insurance uses income replacement if you can not work as a result of injury or health problem. By familiarizing on your own with these choices, you can make educated choices that line up with your needs and goals, ultimately reinforcing your economic security.

Assessing Your Insurance Policy Requirements

Exactly how can you guarantee you have the right coverage for your special scenarios? Start by taking a close check out your way of life, assets, and potential risks.

Take into consideration variables like your age, health and wellness, household situation, and the worth of your belongings. Make a listing of what's most important to secure-- whether it's your home, car, or personal valuables.

Next off, assess any existing insurance coverage you currently have. Are there spaces? Do https://shane41marica.bravejournal.net/check-out-the-8-usual-mistakes-to-stay-away-from-while-working-alongside need essentially coverage in particular areas?

Talk to an insurance coverage professional who can aid identify your requirements based on your situation. Inevitably, recognizing your personal threats and economic obligations will certainly guide you in selecting the ideal insurance plan to provide comfort.

Tips for Contrasting Insurance Coverage

What should you try to find when contrasting insurance plan? Beginning by checking out protection choices. Make sure the plans cover the details threats you're worried regarding.

Next off, examine the premiums-- contrast expenses, but do not make rate your just determining variable. Take a look at deductibles; a lower costs frequently means a greater deductible, which could affect your funds throughout a case.

Analyze the insurance firm's online reputation by checking out evaluations and checking their monetary security. Also, understand the insurance claims procedure-- guarantee it's straightforward and straightforward.

Ultimately, do not fail to remember to ask about price cuts; lots of insurance firms use discounts for packing policies or having a good driving document. Taking https://zenwriting.net/janise5jamison/the-essential-nature-of-personal-insurance-coverage-just-how-to-protect-your helps you make an informed choice that finest matches your demands.

Verdict

To conclude, navigating personal insurance doesn't have to be overwhelming. By recognizing simply click the next website page of insurance coverage, assessing your one-of-a-kind requirements, and comparing plans, you can make informed decisions that shield your assets and well-being. Do not wait to speak with specialists for customized guidance, and keep in mind to assess your plans on a regular basis. With a positive technique, you can ensure you have the best coverage while optimizing your advantages and decreasing expenses. Remain notified and protected!

SPOILER ALERT!

When Checking Out Exactly How An Insurance Company Safeguards Your Properties, Recognize The Vital Aspects To Review Before Choosing The Proper Coverage For Your Demands

Content By-Skaarup Castillo

When it pertains to shielding your properties, recognizing the duty of an insurance agency is vital. These agencies offer tailored insurance coverage alternatives that fit your one-of-a-kind requirements, leading you via the intricacies of choosing the best policies. However exactly how do you know which firm is genuinely best for you? The solution depends on checking out the solutions they offer and the value of tailored remedies. Let's discover what source for this article require to consider prior to choosing.

When you think of shielding your assets, recognizing the solutions offered by insurance firms is vital.

Insurance coverage firms provide a series of solutions that can aid guard your economic health and wellbeing. They offer various sorts of protection, including home, auto, and life insurance policy, tailored to meet your particular needs. By analyzing your scenario, they can recommend policies that secure your valuable belongings and offer satisfaction.

On top of that, firms help you browse the complexities of cases procedures, ensuring you obtain ample support when required. They also inform you on risk monitoring methods to decrease possible losses.

Personalized insurance remedies are vital due to the fact that they resolve your one-of-a-kind situations and needs. Every person or company has certain risks and requirements, and a one-size-fits-all plan simply will not suffice.

Tailored insurance coverage helps guarantee you're effectively covered, whether it's for your home, company, or personal assets.

When you deal with an insurance coverage company that prioritizes personalization, you gain access to skilled advice on what types of coverage are most relevant to you. This technique not just secures your properties yet also provides comfort.

You won't need to stress over spaces in protection or paying too much for unneeded securities. With personalized remedies, you can with confidence browse life's unpredictabilities, recognizing your properties are protected according to your private needs.

Discovering the ideal insurance policy agency can make all the distinction in protecting the customized coverage you need. Start by determining your certain demands-- whether it's automobile, home, or life insurance policy.

Research companies in your area, examining on the internet reviews and ratings. Look for click the up coming post with a strong online reputation and a variety of products that fit your demands.

Next, schedule examinations to assess their customer care and experience. Ask about their experience with customers in similar situations and how they manage insurance claims.

Don't be reluctant to inquire about rates and available discount rates. Ultimately, trust fund your instincts; select a company that makes you really feel comfortable and valued.

This collaboration will certainly be critical in safeguarding your assets successfully.

To conclude, partnering with an insurance policy firm is vital for protecting your possessions and guaranteeing you have the ideal insurance coverage. By recognizing the solutions they offer and the relevance of customized remedies, you can make informed decisions that enhance your monetary safety and security. Put in the time to choose an agency that lines up with your needs, and you'll obtain satisfaction knowing you're secured versus life's uncertainties. Do not wait-- safeguard your future today!

When it pertains to shielding your properties, recognizing the duty of an insurance agency is vital. These agencies offer tailored insurance coverage alternatives that fit your one-of-a-kind requirements, leading you via the intricacies of choosing the best policies. However exactly how do you know which firm is genuinely best for you? The solution depends on checking out the solutions they offer and the value of tailored remedies. Let's discover what source for this article require to consider prior to choosing.

Comprehending the Providers Used by Insurance Policy Agencies

When you think of shielding your assets, recognizing the solutions offered by insurance firms is vital.

Insurance coverage firms provide a series of solutions that can aid guard your economic health and wellbeing. They offer various sorts of protection, including home, auto, and life insurance policy, tailored to meet your particular needs. By analyzing your scenario, they can recommend policies that secure your valuable belongings and offer satisfaction.

On top of that, firms help you browse the complexities of cases procedures, ensuring you obtain ample support when required. They also inform you on risk monitoring methods to decrease possible losses.

The Importance of Personalized Insurance Policy Solutions

Personalized insurance remedies are vital due to the fact that they resolve your one-of-a-kind situations and needs. Every person or company has certain risks and requirements, and a one-size-fits-all plan simply will not suffice.

Tailored insurance coverage helps guarantee you're effectively covered, whether it's for your home, company, or personal assets.

When you deal with an insurance coverage company that prioritizes personalization, you gain access to skilled advice on what types of coverage are most relevant to you. This technique not just secures your properties yet also provides comfort.

You won't need to stress over spaces in protection or paying too much for unneeded securities. With personalized remedies, you can with confidence browse life's unpredictabilities, recognizing your properties are protected according to your private needs.

Just how to Choose the Right Insurance Coverage Agency for Your Needs

Discovering the ideal insurance policy agency can make all the distinction in protecting the customized coverage you need. Start by determining your certain demands-- whether it's automobile, home, or life insurance policy.

Research companies in your area, examining on the internet reviews and ratings. Look for click the up coming post with a strong online reputation and a variety of products that fit your demands.

Next, schedule examinations to assess their customer care and experience. Ask about their experience with customers in similar situations and how they manage insurance claims.

Don't be reluctant to inquire about rates and available discount rates. Ultimately, trust fund your instincts; select a company that makes you really feel comfortable and valued.

This collaboration will certainly be critical in safeguarding your assets successfully.

Final thought

To conclude, partnering with an insurance policy firm is vital for protecting your possessions and guaranteeing you have the ideal insurance coverage. By recognizing the solutions they offer and the relevance of customized remedies, you can make informed decisions that enhance your monetary safety and security. Put in the time to choose an agency that lines up with your needs, and you'll obtain satisfaction knowing you're secured versus life's uncertainties. Do not wait-- safeguard your future today!

SPOILER ALERT!

A Consecutive Guide To Embarking On Your Career As An Insurance Representative

Content Produce By-Morin Trujillo

Beginning your profession as an insurance agent can be a gratifying journey, but it needs careful planning and execution. You need to understand the various types of insurance policy readily available and the certain demands in your state. As soon as you have actually got that down, the path to getting your license is the following step. Yet what follows that? Let's check out just how to build your customer base effectively and established yourself up for long-term success.

When you start your job as an insurance coverage representative, it's critical to recognize the various kinds of insurance policy available.

You'll come across numerous options, including life, health, automobile, and home owners insurance. Each type serves an one-of-a-kind function and satisfies specific needs for customers. Life insurance policy supplies monetary safety for loved ones, while medical insurance covers clinical expenses. Vehicle insurance policy protects versus vehicle-related incidents, and property owners insurance policy safeguards residential property and belongings.

Acquainting on your own with these choices will aid you tailor options for your clients. In addition, comprehending the nuances of insurance coverage, exemptions, and policy limitations is crucial. This understanding not just constructs trust yet additionally positions you as a reputable resource.

Recognizing the various sorts of insurance coverage sets the stage for the following action in your trip: acquiring your insurance policy license.

To begin, check your state's demands, as they can differ considerably. Usually, you'll need to complete pre-licensing education, which covers necessary subjects like policy kinds and regulations.

Once you've finished your coursework, you'll require to arrange your licensing test. Make certain you examine extensively, as passing this test is critical.

After passing, you can look for your license with your state's insurance division. Be prepared to supply individual info and perhaps undergo a background check.

Once you receive your certificate, you're one step better to launching your career as an insurance coverage representative!

As you start your trip as an insurance representative, structure and growing your client base is important for lasting success. Begin by leveraging your individual network. Reach out to household, friends, and associates, letting them understand about your new function.

Go to local occasions and sign up with area groups to connect with potential customers.

Make What Does Condo Insurance Cover of social media systems to display your experience and engage with your target market. Create beneficial web content that deals with common insurance policy questions.

Do not underestimate the power of references; ask completely satisfied clients for intros to others.

Keep arranged by monitoring leads and following up regularly. Remember, https://www.investopedia.com/how-other-natural-disaster-prone-countries-deal-with-home-insurance-8780085 -- focus on offering phenomenal service to cultivate trust and commitment.

With commitment and initiative, you'll continuously broaden your client base.

Starting your career as an insurance policy agent can be a fulfilling journey. By comprehending the numerous sorts of insurance policy, acquiring your certificate, and actively developing your customer base, you established the stage for success. Keep in mind to support your connections with clients via superb service and constant follow-ups. With devotion and effort, you'll not only expand your business but additionally make a favorable impact in your customers' lives. Accept the process, and see your profession flourish!

Beginning your profession as an insurance agent can be a gratifying journey, but it needs careful planning and execution. You need to understand the various types of insurance policy readily available and the certain demands in your state. As soon as you have actually got that down, the path to getting your license is the following step. Yet what follows that? Let's check out just how to build your customer base effectively and established yourself up for long-term success.

Recognizing the Various Kinds Of Insurance

When you start your job as an insurance coverage representative, it's critical to recognize the various kinds of insurance policy available.

You'll come across numerous options, including life, health, automobile, and home owners insurance. Each type serves an one-of-a-kind function and satisfies specific needs for customers. Life insurance policy supplies monetary safety for loved ones, while medical insurance covers clinical expenses. Vehicle insurance policy protects versus vehicle-related incidents, and property owners insurance policy safeguards residential property and belongings.

Acquainting on your own with these choices will aid you tailor options for your clients. In addition, comprehending the nuances of insurance coverage, exemptions, and policy limitations is crucial. This understanding not just constructs trust yet additionally positions you as a reputable resource.

Obtaining Your Insurance License

Recognizing the various sorts of insurance coverage sets the stage for the following action in your trip: acquiring your insurance policy license.

To begin, check your state's demands, as they can differ considerably. Usually, you'll need to complete pre-licensing education, which covers necessary subjects like policy kinds and regulations.

Once you've finished your coursework, you'll require to arrange your licensing test. Make certain you examine extensively, as passing this test is critical.

After passing, you can look for your license with your state's insurance division. Be prepared to supply individual info and perhaps undergo a background check.

Once you receive your certificate, you're one step better to launching your career as an insurance coverage representative!

Structure and Expanding Your Client Base

As you start your trip as an insurance representative, structure and growing your client base is important for lasting success. Begin by leveraging your individual network. Reach out to household, friends, and associates, letting them understand about your new function.

Go to local occasions and sign up with area groups to connect with potential customers.

Make What Does Condo Insurance Cover of social media systems to display your experience and engage with your target market. Create beneficial web content that deals with common insurance policy questions.

Do not underestimate the power of references; ask completely satisfied clients for intros to others.

Keep arranged by monitoring leads and following up regularly. Remember, https://www.investopedia.com/how-other-natural-disaster-prone-countries-deal-with-home-insurance-8780085 -- focus on offering phenomenal service to cultivate trust and commitment.

With commitment and initiative, you'll continuously broaden your client base.

Verdict